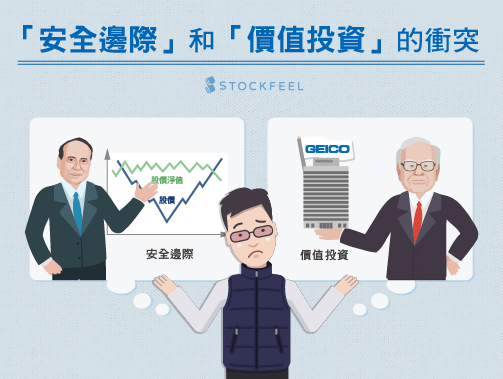

蒙格認為:不要說跟巴菲特比,就算跟我比,葛拉漢都不算個咖。他寫書、教書還算不錯,也是個聰明人,但論投資,他還有很多要學。

這不是蒙格的原話,所以我沒用引號,而是把他幾句原話剪接在一起,但我認為這就是他對葛拉漢的看法。

在一篇2014年蒙格接受華爾街日報的訪談中,看到他如何談葛拉漢,內容用字遣詞之直白,不難看出他當年應該是花了很大力氣,才將巴菲特從葛拉漢的投資系統拉到今日的波克夏(Berkshire Hathaway, BRK.A-US)投資學。

蒙格並不像巴菲特一般喜歡葛拉漢及其投資哲學,他認為葛拉漢的方法是在30年代大蕭條時代所形塑出來的,在海嘯的浩劫餘生後,葛拉漢終其一生都站在岸上,從未航向大海。

投資在一些股價遠低於資產價值但缺乏潛力的公司,只能賺些小錢,如果用葛拉漢的方法,永遠不可能像我們(巴菲特和蒙格)現在累積出如此大的財富。

巴菲特超喜歡蒙格,除了兩人有很多相似的價值觀之外,我猜,蒙格總是能很直白地說出巴菲特心中想說的話,不像他自己總是要幫別人顧些顏面。

如果想了解波克夏的成功之道,少了蒙格恐怕會缺少一大塊。

在併購See’s Candy的交易中,巴菲特一度因為對方出價太貴而想放棄,但在蒙格的勸說之下,勉為其難的出了2,500萬,但仍低於對方出的3,000萬,最後所幸對方讓步了,現在See’s Candy所帶來的報酬豈止百倍,他差一點為了500萬損失了價值百億的機會。

從這段訪談中可以看出,蒙格對未來前景看好的公司更有興趣,而非傳統價值派的鑽研財務報表,找出低估的股票,這個觀念也幫巴菲特從證券分析師轉型成企業分析師,最後造就了前無古人後無來者的波克夏帝國。

難怪巴菲特常說:「我對蒙格的感激,溢於言表。」

蒙格:

I don’t love Ben Graham and his ideas the way Warren does. You have to understand, to Warren — who discovered him at such a young age and then went to work for him — Ben Graham’s insights changed his whole life, and he spent much of his early years worshiping the master at close range. But I have to say, Ben Graham had a lot to learn as an investor. His ideas of how to value companies were all shaped by how the Great Crash and the Depression almost destroyed him, and he was always a little afraid of what the market can do. It left him with an aftermath of fear for the rest of his life, and all his methods were designed to keep that at bay.

I think Ben Graham wasn’t nearly as good an investor as Warren Buffett is or even as good as I am. Buying those cheap, cigar-butt stocks [companies with limited potential growth selling at a fraction of what they would be worth in a takeover or liquidation] was a snare and a delusion, and it would never work with the kinds of sums of money we have. You can’t do it with billions of dollars or even many millions of dollars. But he was a very good writer and a very good teacher and a brilliant man, one of the only intellectuals – probably the only intellectual — in the investing business at the time.

找藉口很簡單-改善投資績效卻很難.png)